Best Tally Computer Course Training Institute in Jaipur

(Certified Business Accounting & Taxation Course)

Enrolling in an accredited Business Accounting Tally Course and Taxation Course Program is mandatory if you want to pursue a successful career in business accounting and taxation Business Accounting Tax. Your CBAT certification gives you the knowledge and abilities of Tally Prime Software and GST, Tax Calculation, filing to succeed in this Business Accounting area. This article will walk you through the process of locating the top accredited Business Accounting & Tax course institute in Jaipur if you live in the Pink City (also known as the Paris of India) and are looking for a reputable institution to pursue your Business Accounting and Taxation course, then we are here to help you with any tax difficulty you may have. We will educate you every module of taxes and assist you with any queries you may face.

CBAT (Certified Business Accountant and Taxation) is a highly practical, career-oriented certified Tally With GST Course In Jaipur for Undergraduates, Graduates, and Postgraduates who desire to pursue professions in accounting and tax. Tally with GST Subject matter experts in the area provide students with the most important information and skills in this course. The students earned assured jobs in renowned organizations and succeeded in their careers as a result of the important practical experience they gained from our Certified Business Accountant & Taxation Course.

Certified BAT Course Features

(Certified Business Accounting &Taxation Course)

Certified Business Accountant & Tax Expert Course Offered by Professional Training Academy is Rajasthan’s Largest Career Building Program Training Institute in Jaipur. CBAT Program is Specially Designed for Job Aspirants who are looking for a career in Core accounts & Finance .

100% Job Guarantee Fee Refund

Job Oriented Practical Trainings

Communication & Interview Skills

Professional & Entrepreneurial Skills

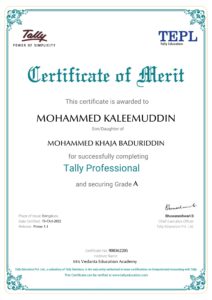

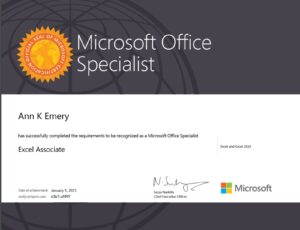

Industry Recognized Certificates

CA's , CS & Industry Faculty

Journey of CBAT Student

If you want to become a job-ready Certified Business Accountant & Taxation Expert or begin your journey as a CBAT student with a recognized certified course in accounting & taxation by Marg academy (a leading firm that has trained 25000+ young practitioners in accounting, finance, inventory, and human resources), which is our resource & certification partner firm for this specific course.

Certified BAT Course Learning Modules

Certified Business Accountant and Taxation Expert Course Training Institute in Jaipur by CBAT India comprises 15+ learning modules and 4 months of course instruction by industry professionals. The Certified Business Accounting & Taxation Course is a comprehensive course that covers all aspect of accounting and taxation. It completely covers basic accounting principles, financial statement analysis, cost accounting, tax law, and legal compliance. The course incorporates practical training, case studies, and real-world scenarios to ensure that learners get hands-on competency.

- Key Accounting Concepts & Principles

- Types of Accounts

- Recording of Transaction

- Double Entry Accounting Systems

- Closing Entries & Reconciliation Statements

- Preparation of Financial Statements

- Accounting for Inventories

- Tally Software Overview

- Company Creation & Ledger Creation

- Passing Entries in Tally Software

(Sales , Purchase , Bank & Expenses Entries) - Inventory Management in Tally

- Closing Entries & Reconciliation Statements

- Generating and View Trial Balance , & Other Financial Statements

- Understand Tools like Backup , Migration, Printing Invoices etc.

- Financial Statement preparation in Tally

- Advance Accounting Entries in Tally

- Payroll in Tally

- TDS & TCS in Tally

- GST in Tally

- Bank Reconciliation Statements , Important Closing adjustment entries

- Exam Preparation of Tally Exam

- Advance Tools like Data Backup , Data Migration, Data Export & Import , Data transfer in Other Formats , Printing Invoices etc.

- Introduction to MS Excel

- Basic Tools & Shortcuts of MS Excel

- Essential Formula Knowledge in MS Excel

- Data Optimization , Filtration, & Report Presentation

- Data Validation & Protection

- Pivot Tables

- Quantitative Tools & Time value of Money

- Basics of Indirect Tax & GST Concept

- Applicability of GST

- Terminology in GST

- Input Tax Credits

- GST Invoice

- GST Registation

- Important Dates in GST

- Returns in GST

- GST Return Prepration

- GST Return Filings

- Payments & Refund of GST Tax

- Input Tax Credits

- GST Practical filing of Returns like GSTR 1 , GSTR 2, Annual Returns etc.

- Integrated GST Preparations with Tally

- Integrated GST Preparation with MS Excel

- Income Tax Concept

- Income Tax Assesses & Tax Rate

- Basic Ingredient of Income Tax Returns

- Heads of Income Computation

- Tax Deduct at Source , 26 AIS & Various data

integration to Income tax Returns - Integrated ITR Preparation with Tally

- Integrated ITR Preparation with MS Excel

- Advance Tax Concept

- Assistance with CA firm to finalize ITR

- Income Tax Returns Filing & Due Dates

- Income Tax Computation

- Payment of Income Tax & Refunds

- Practical Problem & Solutions in TDS , ITR Returns

- Introduction to Zoho Books

- Introduction to Marg Accounting Software

- Introduction to Busy Accounting Software

- Introduction to SAP & its Modules

- Introduction to ERP Accounting Software

- PAN CARD

- Udhyog AADHAR

- Partnership , HUF, Company , LLP ,Trust & Societies Formation Process

- Trademark & Copy Right

- Payroll Management & Accounting

- Computation of TDS & Filing

- Registration , Computation & Due Dates

of PF, NPS - Computation of Salary , Salary Slips & Record Maintenance

- Registration of ESI , Computation &

Due Dates

- Spot Presentation Skills

- Team Building Activities

- Telephonic Conversations

- Client Management & Interaction

- English Communication

- Office Etiquette

- Interpersonal Skills

- How to Handle Front End Desk , Billings & Cash management

- E Mail & Virtual Communication

- Office Records & Document Management

- Behavioural Skills

- How to Prepare a resume /CV

- Create Linked In Profile

- Interview Questions & Preparation

- Interview Do’s & Don’ts

- Mock Interview Drills

- How to Setup Accounting &

- Tax Consultancy

- Cross products with Accounting & Taxation

- Digital Marketing to Boost Consultancy Business

- Free Lance Project on Accounting & Taxations

Certified BAT Course Program Head

Meets with the Founder and program head of Certified Business Accountant and Taxation Expert(CBAT) Course training Institute in Jaipur.

Rohan Sharma

CFP, Chartered Secretary (CS), CMT

“The secret to winning is Constant, Consistent, Experience & Patience”

Rohan Sharma achievements over his 11 year career in financial markets spanning across Retail stock broking, high end trainings and Investment Management for Corporates make him an authority in the area of his expertise.. We are passionate to set a new standard of institutional excellence and create the most efficient and profitable environment for our investors.

Founder & Program Head CBAT

आज ही अकॉउंटिंग कोर्स की विस्तृत जानकारी के लिए खुद को रजिस्टर करे

Free Counselling Form

Call Now : 9261211003

Certified BAT Course Key Persons

(Certified Business Accounting &Taxation Course)

Meets with the key persons of Certified Business Accountant and Tax Expert BAT Course Institute in Jaipur.

Divye Dutt Agarwal

Company Secretary & LLB

He is a fellow member of Institute of Companies Secretaries of India with 16 years standing in the profession.

He holds a LLB Degree from Rajasthan University with concentration in Legal and Management Consulting. With 10 years of post-qualification experience, he has extensively worked on several consulting cases across diverse verticals and has served clients ranging from global MNCs to SMEs, handling end-to-end engagement lifecycle.

He is also an active member of various management groups & associations. He holds experience in credit appraisal and bank finance with various private banks and nationalized banks.

Neha Khatri

Founder of Practicing CA Firm

She is an Associate Member of Institute of Chartered Accountants of India with 8 years standing in the profession. She has wide experience in the field of Indirect Taxes, Assurance and Accounting. She specializes in taxation matters GST and Auditing.

With 8 years of post-qualification experience, She has extensively worked on several consulting cases across diverse verticals and has served clients ranging from global MNCs to SMEs, handling end-to-end engagement lifecycle.

She is also an active member of various management groups & associations. She holds experience in credit appraisal and bank finance with various private banks and nationalized banks.

Alok Jagga

Communication Coach Corporate Trainer

He has been working since the age of 18. He Graduated, Mastered and got certified along side of work.

Roles changed from a consultant to a Buddy coach to quality analyst to Product trainer to a trainer of English. He has been instructing under various banners for close to 2 decades.

He loves instructing at colleges and Academies or corporates. Teach as it allows me to interact and upgrade.

He is Verbal Trainer for GMAT, GRE and SAT at Jamboree Education Private Limited.

Certified BAT Candidate Job Roles

Certified Business Accountants and Tax Experts hold a number of positions in the Accounting and Taxation fields. The programme is specifically designed for job seekers interested in a career in core accounting and finance.

KPO Process Associates

GST & Tax Manager

Front End Desk Manager

Accountant

Assistant to CA, CS Firms

Cash & Billing Manager

Certified BAT Course Accreditations By

Certified BAT Candidate Industry Partners

CBAT Experts works with a wide range of industry partners in the accounting and taxes fields. They will also provide you with the greatest positions in this field

KPO like Genpact, Infosys ,NAV

Retail Stores like Reliance Retail, Shopper Stop etc

Hospitals, Medical Stores, Labs, Clinics.

Hotels, Restaurant, Café, Food Chain Stores

CA, CS Firms

Traders, Wholesalers, Factory Outlets, Manufacturer, Educational Institutes

Certified Business Accountant & Tax Expert CBAT FAQs

CBAT, or Certified Business Accounting & Tax, is an innovative programme that provides students with the knowledge and skills they need to thrive in the profession of accounting and taxes. In this post, we’ll go through the CBAT course in depth and talk about how it may help you develop in your career.

The CBAT course is a professional certification programme that prepares students for professions in accounting and taxes. Financial accounting, managerial accounting, tax preparation, auditing, and company law are among the topics covered in the programme. Several educational institutions, including colleges and universities, as well as online learning platforms, offer the CBAT course.

The CBAT course is appropriate for anybody who wants to work in accounting or tax preparation. Recent high school grads, college students, and professionals wishing to change occupations are all eligible. The training is also useful for small company owners who wish to learn more about accounting and tax legislation.

Taking the CBAT course has various advantages, including:

Curriculum that is comprehensive, professional certifications, industry-relevant skills, course flexibility, career advancement, and so forth.